inherited annuity tax calculator

Tax Rules for Inherited Annuities. RMD applies to a traditional IRA or a qualified retirement plan.

Annuity Exclusion Ratio What It Is And How It Works

Tax rate on an inherited annuity.

. 1 Best answer. The earnings are taxable over the life of the payments. In turn taxation of annuity distributions.

IRS Publication 575 says that in general those inheriting annuities pay taxes the same way that the original annuity owner would. Discover Helpful Information And Resources On Taxes From AARP. Those who inherit an IRA and who take distributions from it are taxed on the withdrawn income.

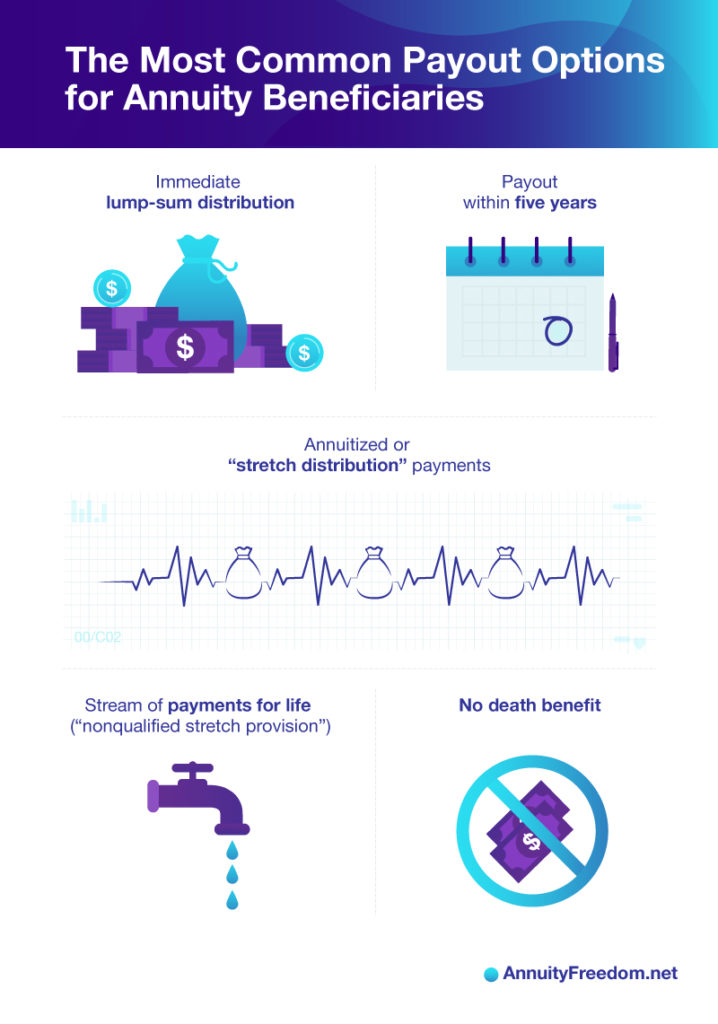

If an annuity contract has a death-benefit provision the owner can designate a beneficiary to inherit the remaining annuity. 2 1936 and the lump-sum distribution is from a qualified retirement annuity you may be able to elect up to five optional methods of. The estate pays estate taxes and rates vary depending on the size of the estate.

Only a spouse can inherit an annuity and benefit from the options the late. Because your wife chose to cash in the annuity a portion of what she received will be income from the invested funds. Death Benefits Payout Options.

Calculate the required minimum distribution from an inherited IRA. The tax rate on an inherited annuity depends on the type of annuity and the beneficiarys relationship to the person who purchased the annuity. Surviving spouses can change the original contract.

The annuities would not have an RMD if your father purchased them. For non-IRA inherited annuities you can receive payments either a single life. An inherited IRA is an account opened to distribute the assets of a deceased owner of an individual retirement account IRA or employer-sponsored plan to the beneficiary or.

Ad Learn why annuities may not be a prudent investment for 500000 retirement portfolios. When an annuity payment is made 50 of each payment would be income taxable. Tax Consequences of Inherited Annuities.

If the annuity is an immediate annuity. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Inheritance Tax guaranteed annuity calculator Use this calculator to help you work out an estimated market value of guaranteed annuity payments when valuing assets of.

Taxes on an inherited annuity are usually dictated by your beneficiary status and how you receive payouts. Different tax consequences exist for spouse versus non-spouse beneficiaries. The money from an inherited annuity can be paid out as a single lump sum which becomes taxable in the year it is received.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. If the payout is over an annuitants lifetime and the annuitant outlives life expectancy all further payments. It sounds like she received the remaining balance so the 1099-R is probably marked as.

Free annuity payout calculator to find the payout amount based on fixed-length or to find the length the fund can last based on a given payment amount. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from. Ad Learn More about How Annuities Work from Fidelity.

If youre the spouse of the. Dear Allen If you were born before Jan. When inheriting an annuity from a parent you will have to pay taxes on payments as ordinary income.

Your wife inherited her mothers annuity. If an annuity is structured to include one or more beneficiaries those individuals will continue to receive payments from the contract after the. June 3 2019 1103 AM.

The beneficiarys relationship to the purchaser and the payout option thats selected can determine how an inherited annuity is. Ad Learn More about How Annuities Work from Fidelity. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

These payments are not tax-free however. Ad Find Visit Today and Find More Results. So for instance if the annuity has 50000 in gains and 50000 in principal you wont receive the tax-free principal until after youve received all of the gains.

This is a one-time lump sum payout upon the death of the annuity owner or annuity owners. Total distribution in box 2b and. Annuities are often complex retirement investment products.

A tax-qualified annuity is one. Learn some startling facts.

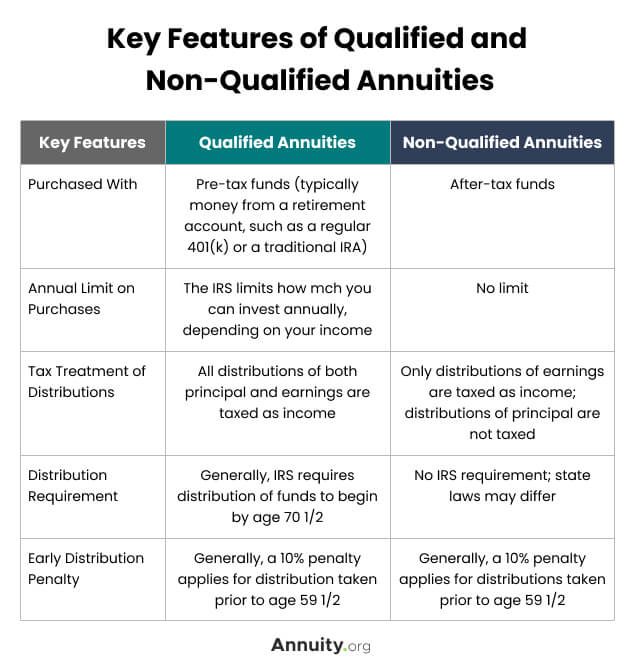

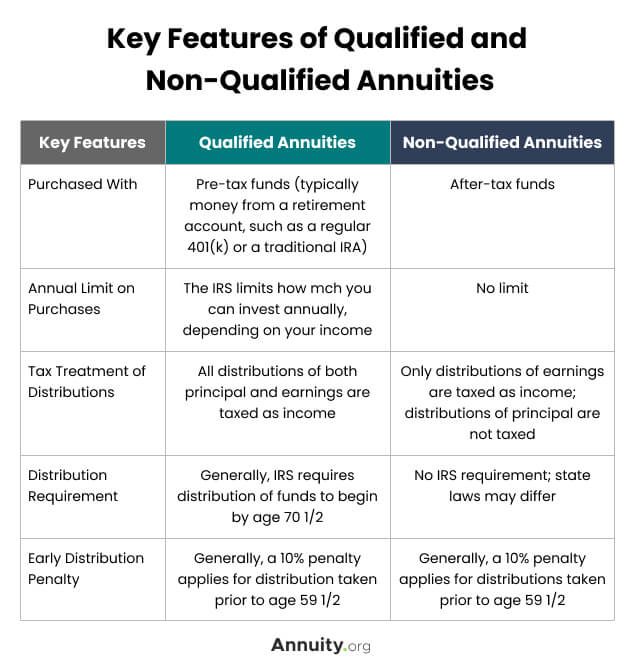

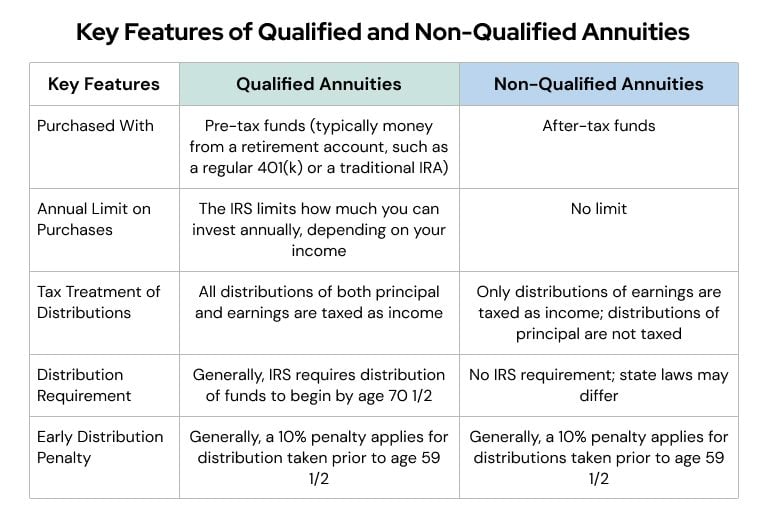

Qualified Vs Non Qualified Annuities Taxation And Distribution

Qualified Vs Non Qualified Annuities Taxes Rmd Retireguide

Own An Inherited Annuity Stretch Your Assets With A Low Cost Tax Efficient Option Kiplinger

Inherited Annuity Tax Guide For Beneficiaries

Annuity Beneficiaries Inheriting An Annuity At Death 2022

Annuity Taxation How Various Annuities Are Taxed

Do I Pay Taxes On All Of An Inherited Annuity Or Just The Gain

How Much Taxes Should I Plan On Paying For My Annuity Valuewalk

Annuity Beneficiaries Inherited Annuities Death

Distribution Options For Inherited Non Qualified Annuities Bsmg Brokers Service Marketing Group

Annuity Beneficiaries Inheriting An Annuity After Death

How To Avoid Paying Taxes On An Inherited Annuity Smartasset

Making Annuity Inheritances More Tax Efficient

Annuity Taxation How Are Annuities Taxed

Inherited Annuity Tax Guide For Beneficiaries

Inherited Annuity Tax Guide For Beneficiaries

Annuity Taxation How Various Annuities Are Taxed